td ameritrade taxes explained

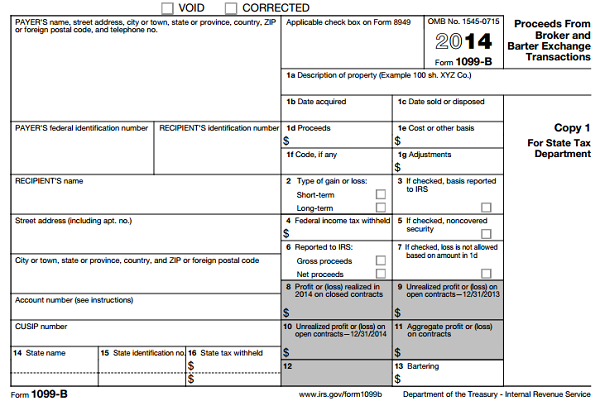

Each time you purchase a security the new position is a distinct and separate tax lot even if you already owned shares of the same security. A tax lot is a record of a transaction and its.

Strategies Rules For Capital Gains Tax On Investments Ticker Tape

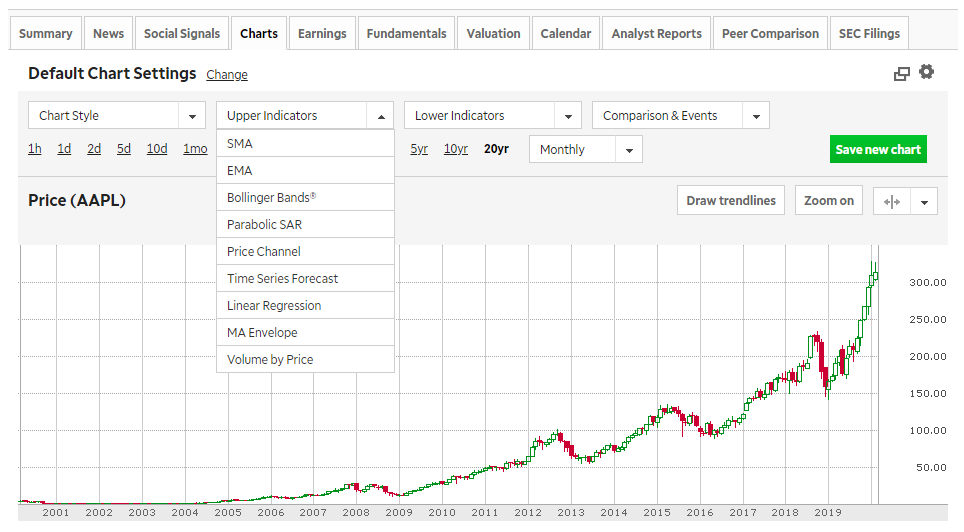

MarketEdge Daily costs 999 while the Plus version costs an extra 10.

. Tax-loss harvesting is not appropriate for all. Select your state of residence. The Realized GainLoss tab lets you filter for a specific time period and displays sells and corporate action events such as mergers and spin-offs see figure 2.

There are two types of capital gains. The tax-loss harvesting feature is currently only available with the TDAIM ETF-based portfolios in taxable TD Ameritrade Investing Accounts. Ordinary dividends of 10 or more from US.

See all contact numbers. TD Ameritrade doesnt have a lot of fees outside of its commissions but there are a few that you should be aware of. 42 mil views 63 likes 0 loves 32 comments 21 shares Facebook Watch Videos from TD Ameritrade.

Unsupported Chrome browser alert. Although Level II quotes are free at TD Ameritrade Level I quotes cost 24 for professional traders. Depending on your activity and portfolio you may get your form earlier.

And foreign corporations capital gains. Select your federal tax rate. Your taxable equivalent yield is Click the Calculate Button.

Enter the yield to maturity or yield to call of the Municipal bond. To log in upgrade to the latest. Below will go over which of these other fees if any could be relevant to.

![]()

1040s 1099s Other Federal Tax Forms What You Mig Ticker Tape

Free Stock Trading Td Ameritrade

Taxes The Business Of Running Your Trading Business Ticker Tape

How To Report Other Receipts And Reconciliations Partnership Distributions Received On A 1099 B From Td Ameritrade On My Tax Return Quora

Here S How To Minimize Taxes When Investing Youtube

Tax Bite Capital Gains Short Term And Long Term Inv Ticker Tape

2022 Td Ameritrade Review Pros Cons Benzinga

Real Estate Taxes A Complete Guide To The Basics The Ascent By Motley Fool

.png)

Charles Schwab Annual Meeting Discusses Td Ameritrade Integration Progress Customer Service Issues Financial Planning

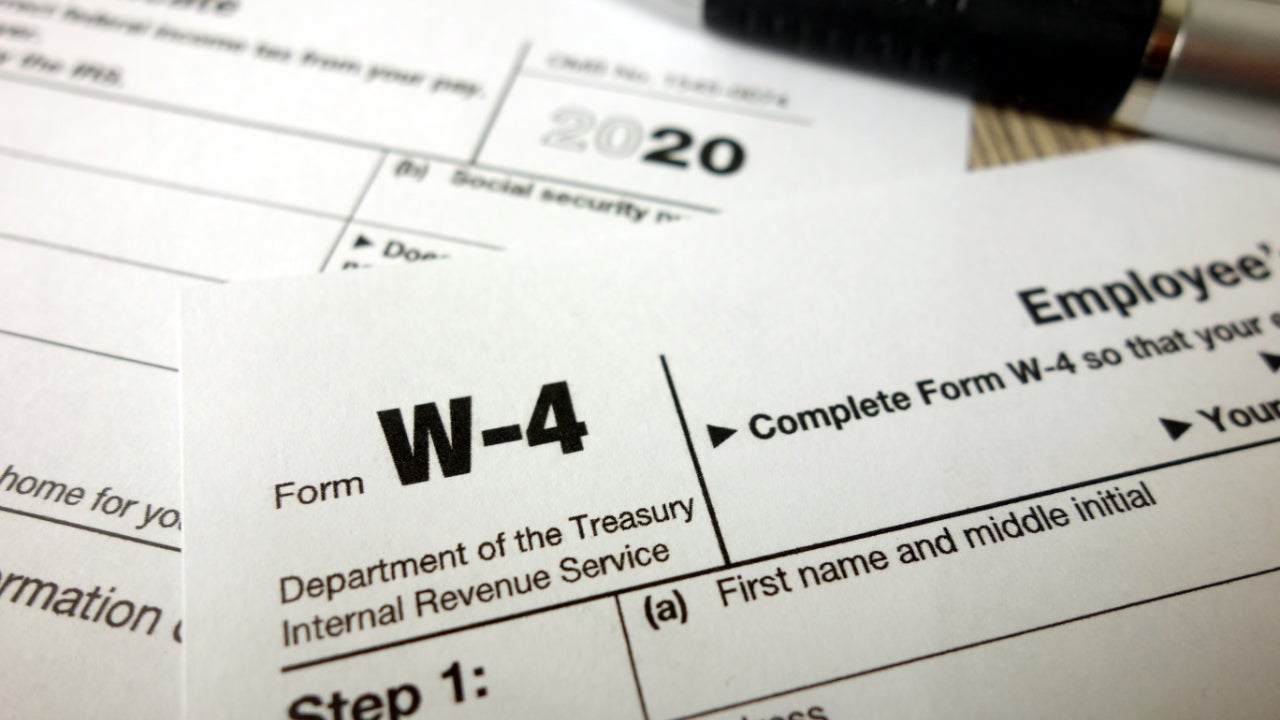

Tax Withholding Definition When And How To Adjust Irs Tax Withholding Bankrate

Tax Loss Harvesting A Guide To Save On Capital Gains

Deciphering Form 1099 B Novel Investor

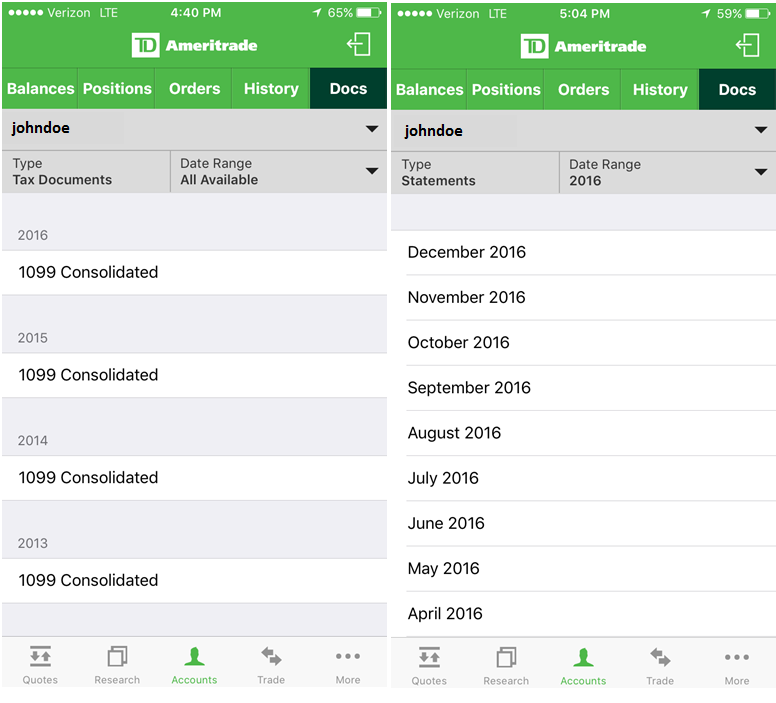

Tax Season And More Made Simpler With The Td Amerit Ticker Tape

Capital Gains Taxes Explained There Are Two Types Of Capital Gains Short Term And Long Term Taxes Can Impact The Growth Of Your Portfolio So It S Important To Understand How By Td

Sales Tax Definition How It Works How To Calculate It Bankrate

Td Ameritrade Review 2022 The College Investor

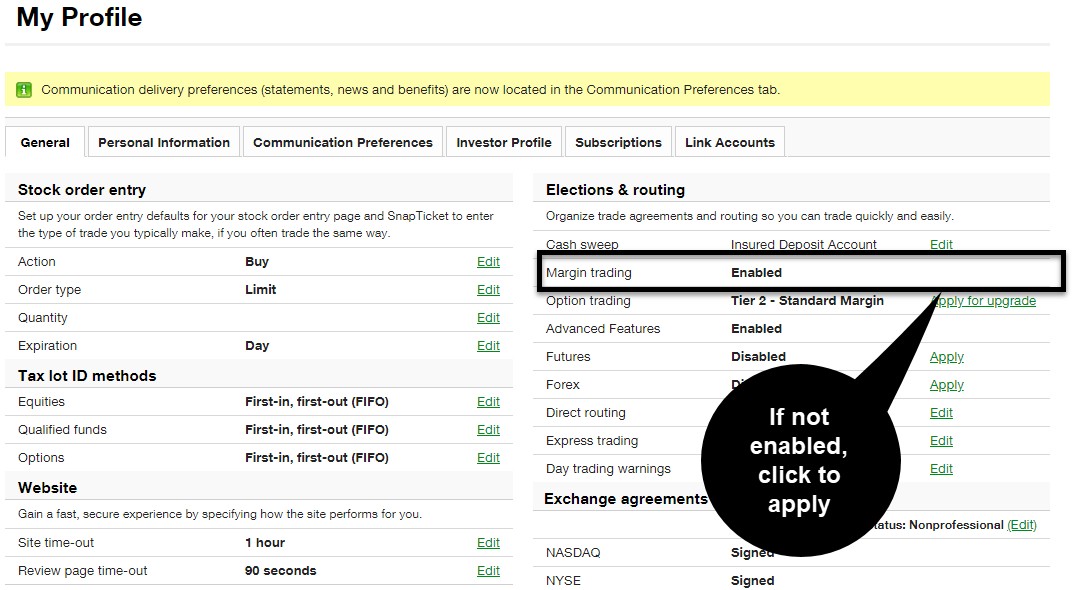

Using Margin Buying Power To Diversify Your Market Ex Ticker Tape

/td_ameritrade_productcard-5c61ed44c9e77c000159c8f6.png)